Theory of Capital Structure ( NI & NOI Approach)BBA 1st /3rd/4th year & MBA Finance YouTube

PPT CAPITAL STRUCTURE PowerPoint Presentation, free download ID2410734

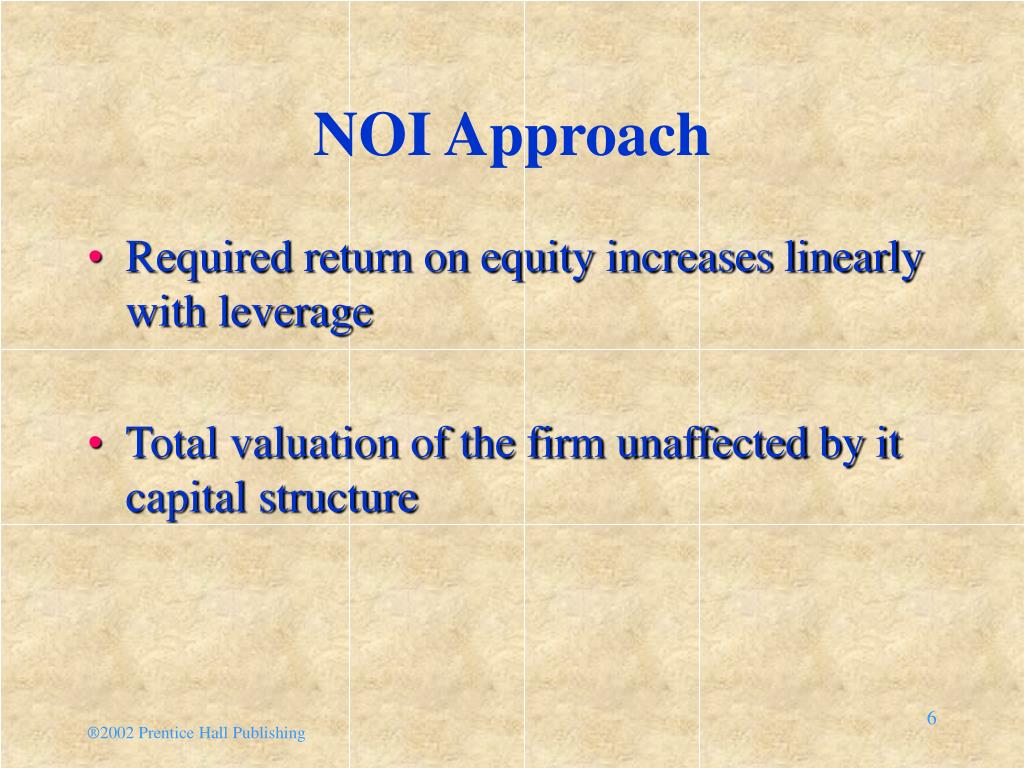

Value of equity is the difference between total firm value and less value of debt, i.e., Value of Equity = Total Value of the Firm - Value of Debt. WACC (Weightage Average Cost of Capital) remains constant, and with the increase in debt, the cost of equity increases.

PPT Chapter 9 Theory of Capital Structure PowerPoint Presentation, free download ID3344317

When it comes to real estate investment, there are various approaches and strategies that investors employ to maximize their returns. Two popular methods that.. Difference Between NI and NOI Approach: Real Estate Investment. December 6, 2023.

NI and NOI approach Capital structures YouTube

Capital Structure Theories and their different approaches put forth the relationship between the proportion of debt in the financing of a company's assets, the weighted average cost of capital (WACC), and the company's market value.

Capital Structure, NI, NOI, Traditional and MM Approach UGC NET/JRF Paper2 Commerce YouTube

A corporate can finance its business mainly by 2 means, i.e., debts and equity. However, the proportion of each of these could vary from business to business. A company can choose to have a structure with 50% each of debt and equity or more of one and less of another.

Capital structure/value of firmfinancial managament (NI,NOI Approach) YouTube

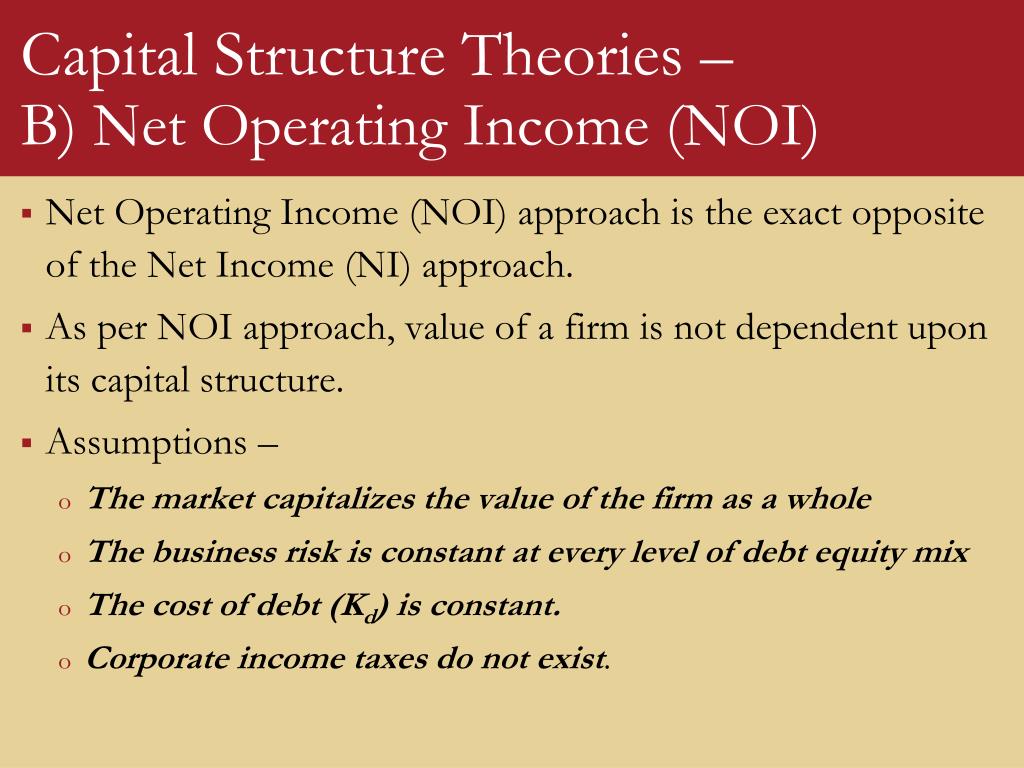

According to Net Operating Income Approach which is just opposite to NI approach, the overall cost of capital and value of firm are independent of capital structure decision and change in degree of financial leverage does not bring about any change in value of firm and cost of capital.

Theory of Capital Structure ( NI & NOI Approach)BBA 1st /3rd/4th year & MBA Finance YouTube

The earning of the firm after the payment of all other expenses except interest on debt is called Net Operating Income (NOI) and the earning available for equity shareholders after the payment of interest is called as "Net Income (NI). Therefore, Net Income = Net Operating Income (NOI) - Interest on debt (I).

⛔ Net operating approach of capital structure. Net operating approach, Durand

Differences between net income (NI) and net operating income (NOI) approach Role of Capital Structure Net Income Approach Net Operating Income Approach Degree of Leverage and Cost of Capital Assumptions WACC = EBIT / (Value of firm)

Net Operating (NOI) Approach Theories of Capital Structure Financial Management

Operating income is revenue less any operating expenses, while net income is operating income less any other non-operating expenses, such as interest and taxes. Operating income includes expenses.

Theories of Capital Structure (NI, NOI, MM Approach) Financial Management [FM], DCM CLASSES

The major differences between net operating income and net income are as follows − Net operating income No relevance in capital structure. Degree of leverage is irrelevant to cost of capital (assumes). It has constant cost of capital. Equity value is residual. Changes perception of investor with increase in debt. Net income

PPT Capital Structure PowerPoint Presentation, free download ID4503828

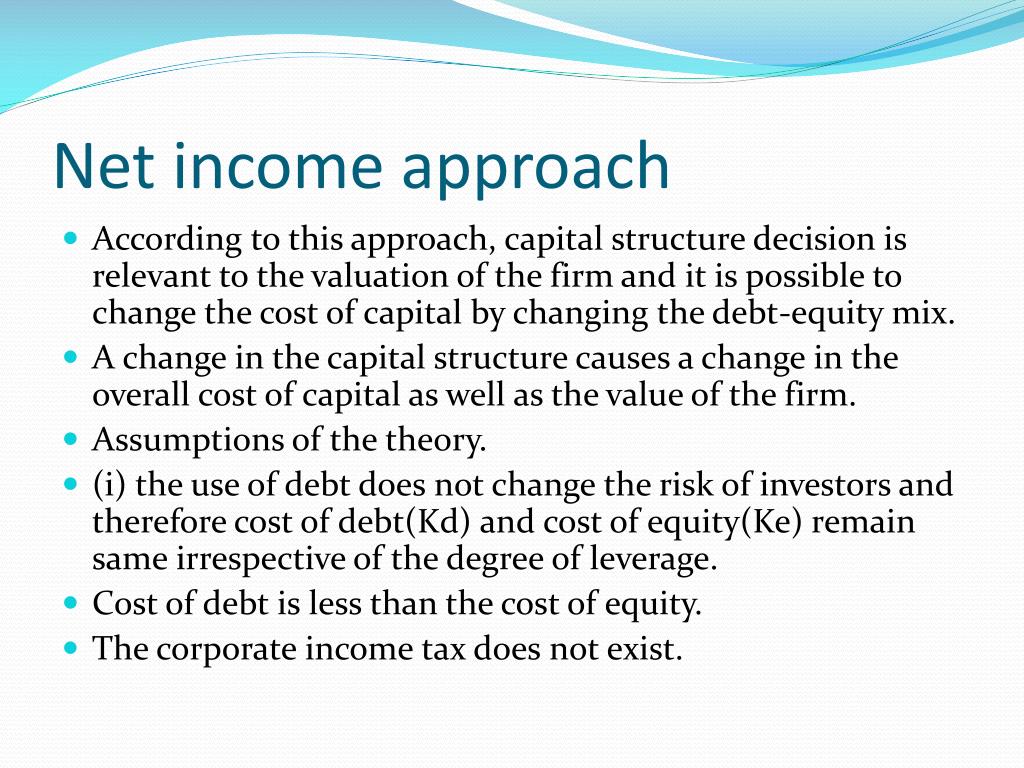

Net Income (NI) approach. Provided by Durand, it says that capital structure is relevant to valuation of firm.. The basic difference between NOI and MM approach is that NOI is purely definitional whereas MM approach provide behavioural justification for the independence of valuation and cost of capital of the firm from its capital structure.

Difference between Net vs. Net Operating Approach

What is the difference between Ni and NOI approach? NI approach is relevant to capital structure decision. It means decision of debt equity mix does affect the WACC and value of the firm. NOI approach evaluates the cost of capital and therefore the optimal Capital Structure on the basis of operating leverage by means of NOI approach.

Financial Operating Approach/NOI Approach/Theory of Capital Structure

A company has to decide the proportion in which it should have its finance and outsider's finance, particularly debt finance. Based on the ratio of finance, WACC and Value of a firm are affected. There are four capital structure theories: net income, net operating income, and traditional and M&M approaches. Capital Structure

part6 NI APPROACH NOI APPROACH TRADITIONAL APPROACH CAPITAL STRUCTURE THEORIES YouTube

The approaches are: 1. Net Income Approach (NI) 2. Net Operating Income Approach (NOI) 3. Traditional Approach 4. Modigliani-Miller (M-M) Approach. Capital Structure Approach # 1. Net Income Approach (NI): Net income approach and net operating income approach were proposed by David Durand.

:max_bytes(150000):strip_icc()/Term-Definitions_noi-4eae808a643c4ca9b130f12fed343370.jpg)

Net Operating (NOI) Definition, Calculation, Components, and Example

What is the difference between the net income (NI) approach, the net operating income (NOI) approach, and the traditional approach? Instant Video Answer. Instant Text Answer. Step 1/2.

3. NI approach) Operating Approach) Practical Questions Capital

Net Operating Income - NOI: Net operating income (NOI) is a calculation used to analyze real estate investments that generate income. Net operating income equals all revenue from the property.

Value of Firm (NI, NOI, MM Approach) Financial Management [FM] For

Difference between firm value and value of debt is value of equity. Cost of equity is larger than cost of debt. Formulas Market value of a firm (V) is ratio of earnings before income taxes (EBIT) and weighted average cost of capital (WACC). V = EBIT/WACC Total equity (E) is difference of market value of a firm (V) and market value of Debt (D).